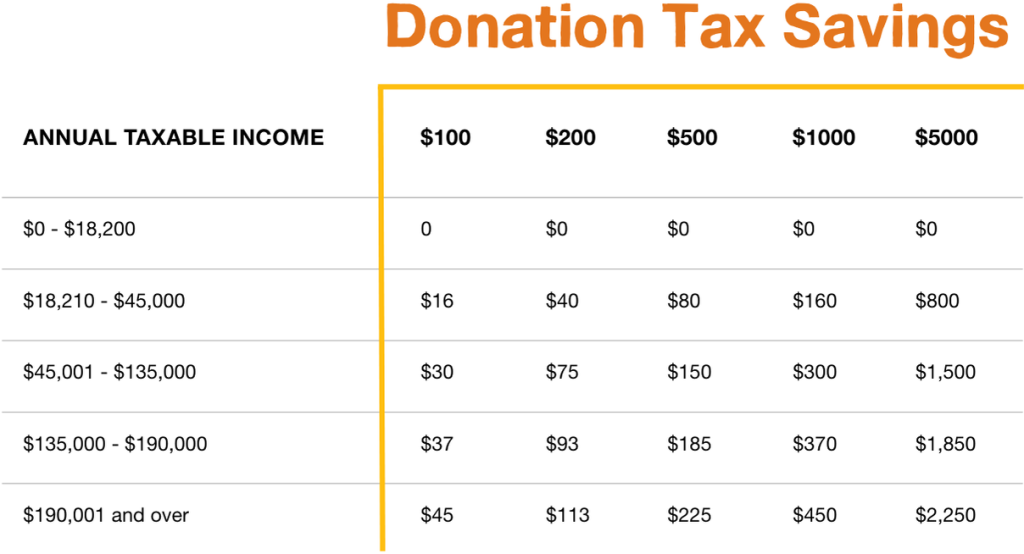

Calculate the impact a charity donation can have on your tax.

Make a difference and make a donation before 30 June to claim tax benefits for this financial year.

By donation to CARE Australia you are supporting women around the world and helping to defeat poverty. Your donation will help those who need it most, delivering education and training, healthcare and clean water, nutritious food, and new ways to earn an income. And in times of crisis, your donation can help us deliver emergency relief.

There is no limit on how much can be claimed, but there is a limit to how much of your donation you’re able to claim in a financial year. This means that a deduction from a donation could reduce your taxable income to zero for a given year, but you are not able to create a loss.

*Calculations based on 2024-2025 ATO income tax rates (excluding the Medicare levy). This information is for general knowledge only and doesn’t constitute personalised advice.

Why donate to CARE Australia?

We strive to be one of the most transparent charities in Australia. When you donate your hard-earned money to CARE Australia, we work hard to ensure your charitable donation has the biggest impact, with complete transparency.

We thank our 22,785 donors who contributed $12.3 million to our work over the past year. Every dollar counts. And that support helped us generate a further $65.4 million from other sources. It’s through the incredible generosity of Australians that we were able to directly assist more than 1.44 million people across 14 countries.

To help us assist even more people, please donate today.

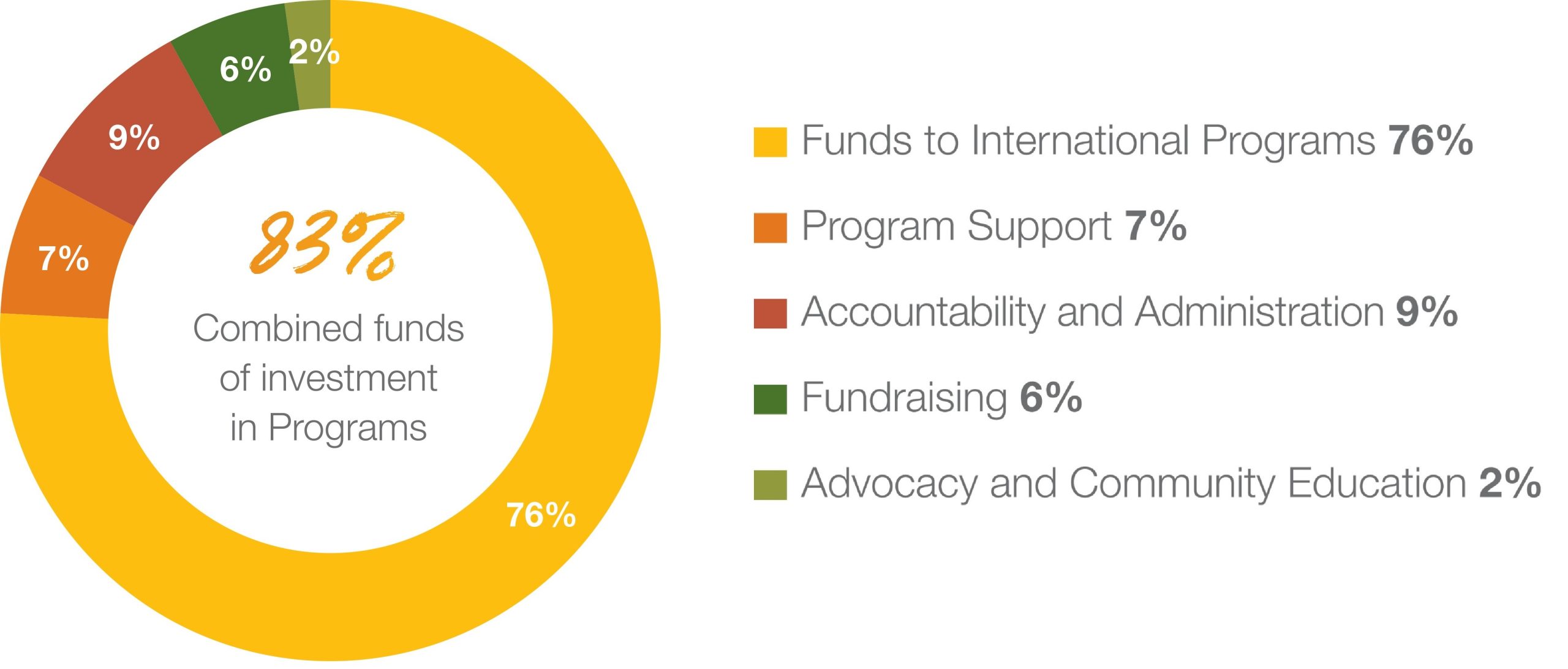

Where the money goes

In 2023/24, CARE Australia spent:

- 83% combined funds of investment in programs

- 9% of total expenditure on accountability, administration and our talented people

- 6% of total expenditure to raise future funds

- 2% on advocacy and community education

For more information, you can read our Annual Reports or find out more about where the money goes.

Frequently Asked Questions

Are charity donations tax deductible?

CARE Australia is a deductible gift recipient (DGR), which means we are an organisation that can receive tax deductible gifts. Any donations you make to CARE Australia over $2 are tax deductible.

How do tax deductible donations work?

If a donation is over $2 and to a deductible gift recipient (DGR charity), donors can deduct the amount of their donation from their taxable income when they lodge their tax return.

How much of a donation is tax deductible?

You can claim the full gift amount, but it must be $2 or more. There is no limit to how much of your donation you’re able to claim in a financial year, in that a deduction from a donation could reduce your taxable income to zero for a given year, but you are not able to create a loss.

What type of donations are tax deductible?

It must truly be a gift or donation – that is, you are voluntarily transferring money without receiving any material benefit or advantage in return. You can only claim a tax deduction for gifts or donations to organisations that have the status of deductible gift recipients (DGRs).

Are donations 100% tax deductible?

As long as your donation is $2 or more, and you make it to a deductible gift recipient charity, you can claim the full amount of money that you donated on your tax return. However, if your taxable income has been reduced to $0, you cannot claim past this point as a loss.

How do donations affect taxes?

If a donation is tax deductible, donors can deduct the amount of their donation from their taxable income when they lodge their tax return.

How much can you donate to charity for taxes?

There is no limit on how much can be donated, but there is a limit to how much of your donation you’re able to claim in a financial year. This means that a deduction from a donation could reduce your taxable income to zero for a given year, but you are not able to create a loss.

How do I get a tax write off for donations?

As long as your donation is $2 or more, and you make it to a deductible gift recipient charity, you can claim the full amount of money that you donated on your tax return. Section D9 on your tax return (Gifts and Donations) deals specifically with charitable donations, so that’s where you should record your donations.

What are the tax benefits of donating to charity?

Your eligible donations are subtracted from your taxable income, decreasing the portion of your income that can be taxed in a given financial year.

What qualifies as a tax deductible donation?

For a donation to be tax deductible, it must be made to an organisation endorsed as a Deductible Gift Recipient (DGR), and must be a genuine gift – you cannot receive any benefit from the donation. This means that purchases from a charity that involve raffle tickets, items or food cannot be claimed as tax deductible gifts.

How do I calculate a donation tax deduction?

Visit our website to use our free tax calculator, and calculate the impact a donation can have on your tax return: https://www.care.org.au/appeals/tax-calculator/

Are overseas donations tax deductible in Australia?

You can only claim a tax deduction for gifts or donations to organisations that have the status of deductible gift recipients (DGRs), like CARE Australia.

The person that makes the gift (the donor) is the person that can claim a deduction, and they must file an Australian tax return.

About CARE Australia

CARE Australia supports women around the globe to save lives, defeat poverty and achieve social justice. We work with local communities to provide women with equal opportunities to earn an income, gain access to their fair share of resources, participate in decisions that affect their lives, and lead their communities through the increasing impacts of climate disasters and other crises.

Donate by phone or mail

Call 1800 020 046 toll free and pay by credit card.

Donations over $2 are tax deductible.

Your donation will go where it is needed most at this time. It will support women who are working hard to defeat poverty and build better lives for themselves and for their families and communities.